Selling Your I Bonds in 2025?

8 Factors to Consider (...and One Simple Rule)

Last Update: January 2025

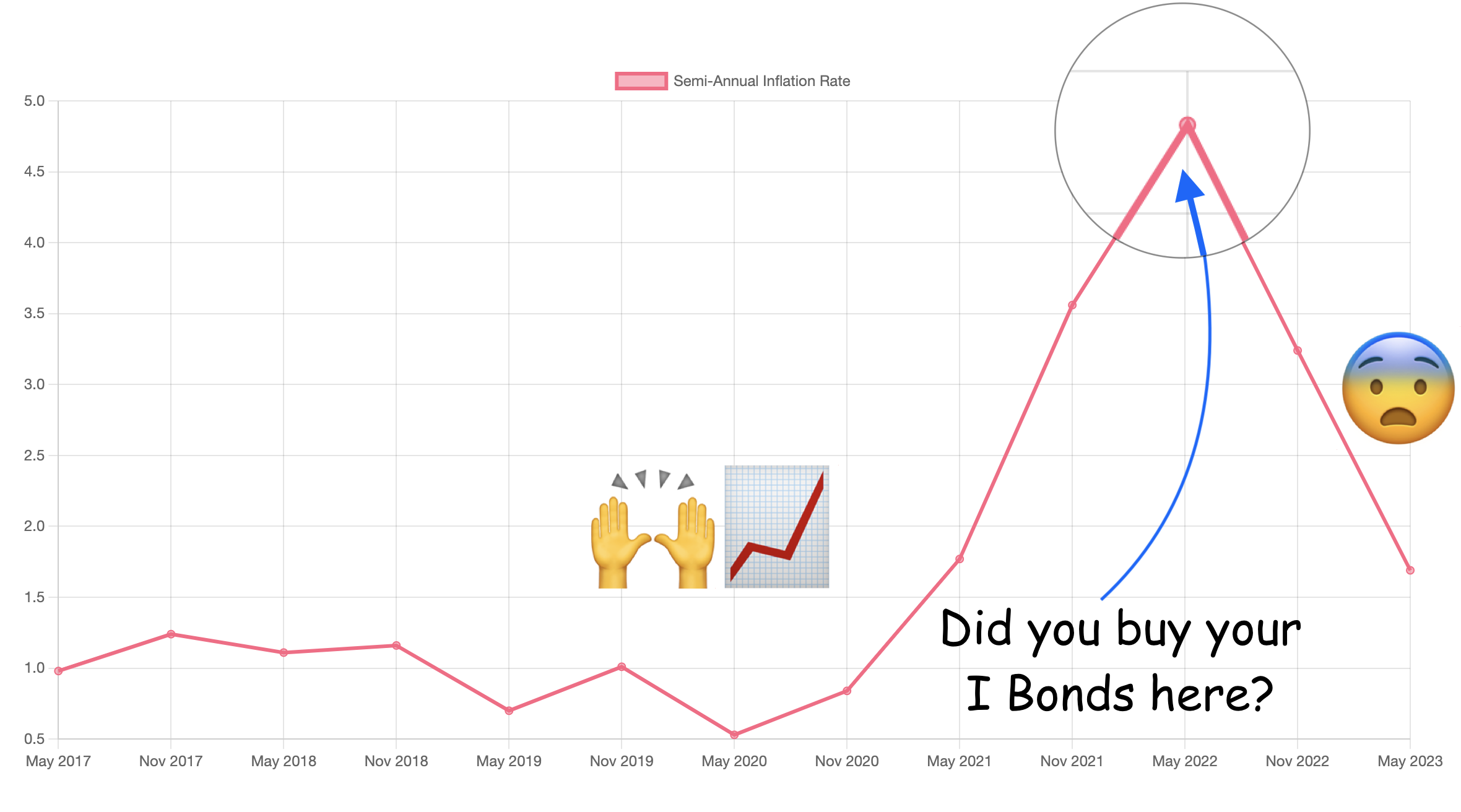

Above: Semi-Annual Inflation Rate of US Treasury Series I Bond, see: Rates Page for more.

So, you saw that juicy 9% rate in 2022, took the plunge on TreasuryDirect.gov and got an I Bond. Nice! Welcome to the party. But as you probably have already seen, rates have dropped substantially since then. What does this mean for your bonds, and should you cash out to find greener places to park your money? What's the optimal time to sell?

Disclaimer: it's no secret that the crew here at YourTreasuryDirect loves I Bonds, and that we think they are a great asset to hold for the long term. However, many of you have asked what factors to consider when selling, so we put together a guide to help folks find the right answer for their financial journey. Every situation is unique, and (taps sign) this is not financial advice.

Below are 8 key factors to think about when considering an I Bond sale, plus one simple rule of thumb.

Be sure to check out the custom calculators designed to help with the math for your specific bond.

Grab a cup of coffee, and let's dive in.

Factor 1: The Falling Inflation Rate

Alas 9% rates, we hardly knew ye

Factor 2: The Rising Fixed Rate

Silver Lining?

However, if you look at the full history of the fixed rate, you'll see that it's been much higher in the past.

Above: Fixed Rate of US Treasury Series I Bond, see: Rates Page for latest.

Was the last decade plus just an abnormally low period for fixed rates? Are >1% fixed rates here to stay? Only time will tell.[3] This matters because the fixed rate is permanent for the entire life of the bond (up to 30 years) and thus a high fixed rate is attractive to investors who are looking to hold long term. Some have even suggested a strategy of cashing in some low fixed rate bonds and buying the newer, high fixed rate bond to be in a better rate position in the future.

Not sure what fixed rate your bond has? Enter the purchase date in calculator below and see how it compares to historical averages.

| Fixed Rate for Your Bond bought in Feb 2020 | 0.20% |

|---|---|

| Average Fixed Rate over the last 5 Years | 0.51% |

| Average Fixed Rate over the last 10 Years | 0.35% |

| Average Fixed Rate All Time | 0.91% |

Factor 3: Alternatives

Because you can't just stuff it into a mattress

Be sure to check out the I Bonds vs. CD's guide as well as others we'll be adding in the future on how to weigh these options against each other, as well as some good resources in the footnotes.[4] [5]

Factor 4: Early Sale Prohibitions and Penalties

Janet sliding in with those hidden fees

Factor 5: Timing

Trying to time the market is usually a losers game, but...

Factor 6: Individual Yearly Purchase Limits

Or, why if you're reading this you're probably not that rich

Why does this matter when considering a sale? Because if you're trying to grow a substantial I Bond portfolio you can only add to it at a rate of ~10k a year. Selling is a one-way street where you won't be able to "catch up" to where you'd be if you had keep plugging in 10k a year.

Factor 7: Partial Sale

For the fence sitters

Treasure this directive, direct from Treasury Direct:

"How much can I cash at one time? Any amount of $25 or more to the penny. If you cash only part of what a bond is worth, you must leave at least $25 in your account. If you cash only part of what a bond is worth, you get the interest only on the part you cash."Why this preoccupation with $25? Under the hood, the Tresury appears to basically treat any size of I Bond as a collection of $25 bonds. Buying $100 I Bond? That's really more like 4 X $25 bonds. This is usually abstracted away and doesn't matter, but does effects things like interest rounding.

Factor 8: Taxes

Just as certain - and usually preferrable to - death

While the IRS allows you to pay incremental interest each year, most folks defer federal taxes on the interest until they sell (or until bond final maturity). You get a Form 1099-INT, available early the following year.[source]

Spending on Higher Education? You might be in for a tax break. Lots of caveats here that I'm not going to get into, but if you think you might be eligible for this check out the details here.